Asset protection is a critical component of financial planning that many individuals and businesses often neglect. This practice involves safeguarding valuable assets from potential risks and liabilities that could compromise their security and value. Asset protection is essential for ensuring long-term financial stability and security, regardless of whether one is a high-net-worth individual, business owner, or investor.

The primary importance of asset protection lies in its ability to mitigate the impact of unforeseen events such as lawsuits, bankruptcy, divorce, or creditor claims. Without proper protection, assets may be at risk of seizure or depletion, potentially leading to financial hardship for individuals and their families. Implementing effective asset protection strategies can shield wealth from potential threats and preserve it for future generations.

Asset protection extends beyond safeguarding wealth from external threats; it also involves minimizing the impact of taxes and other financial obligations. By structuring assets in a strategic and tax-efficient manner, individuals can maximize their value and reduce the amount of taxes and fees they are required to pay. This approach helps retain more hard-earned wealth and ensures continued growth over time.

Key Takeaways

- Asset protection is crucial for safeguarding your wealth and financial future

- Harita Insurance offers numerous benefits for protecting your assets

- Harita Insurance covers a wide range of assets, including property, vehicles, and valuable possessions

- Choosing the right coverage for your assets involves assessing your risks and needs

- Maximizing your asset protection with Harita Insurance involves regular reviews and updates to your coverage

The Benefits of Harita Insurance for Asset Protection

Customized Coverage Options

One of the key benefits of Harita Insurance is its ability to provide customized coverage options that are designed to address specific risks and liabilities. This means that you can tailor your insurance policy to protect against the specific threats that are most relevant to your assets, whether it’s liability claims, property damage, or loss of income. This personalized approach ensures that you have the right level of protection in place to mitigate potential risks and preserve the value of your assets.

Affordable Asset Protection

In addition to customized coverage options, Harita Insurance also offers competitive premiums and flexible payment plans, making it easier for individuals and businesses to access high-quality asset protection solutions without breaking the bank. This affordability factor makes it possible for a wider range of clients to benefit from the peace of mind that comes with knowing their assets are secure and protected.

Comprehensive Asset Protection Solutions

With Harita Insurance, you can rest assured that your assets are protected from a wide range of risks and liabilities. From personal assets to business assets and investment portfolios, Harita Insurance has the expertise and resources to provide comprehensive coverage options that meet your unique needs.

Types of Assets Covered by Harita Insurance

Harita Insurance provides coverage for a wide range of assets, including but not limited to: 1. Real Estate: Whether you own residential or commercial properties, Harita Insurance can provide coverage for your real estate investments. This includes protection against property damage, liability claims, and loss of rental income.

2. Personal Property: From valuable jewelry and artwork to luxury vehicles and collectibles, Harita Insurance offers coverage for a diverse range of personal assets. This ensures that your prized possessions are protected from theft, damage, or loss.

3. Business Assets: For entrepreneurs and business owners, Harita Insurance provides comprehensive coverage for business assets such as equipment, inventory, and intellectual property. This helps safeguard your business against potential financial losses due to unforeseen events.

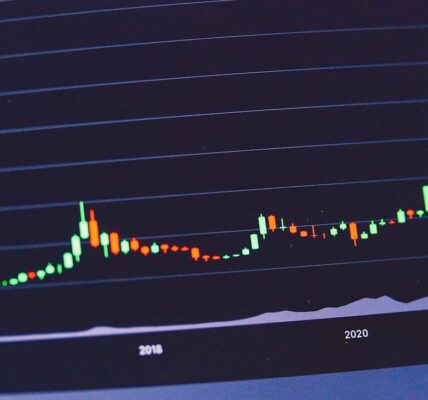

4. Investment Portfolio: If you have a diverse investment portfolio that includes stocks, bonds, and other financial instruments, Harita Insurance can help protect your investments from market volatility and other risks. 5.

High-Value Assets: Individuals with high-value assets such as yachts, private aircraft, and vacation homes can also benefit from specialized coverage options offered by Harita Insurance.

How to Choose the Right Coverage for Your Assets

| Coverage Type | Features | Benefits |

|---|---|---|

| Home Insurance | Property coverage, liability protection | Protection against damage, theft, and personal liability |

| Auto Insurance | Collision coverage, comprehensive coverage | Financial protection in case of accidents, theft, or damage |

| Life Insurance | Term life, whole life, universal life | Financial security for loved ones, investment opportunity |

| Health Insurance | Medical coverage, prescription drug coverage | Access to healthcare, financial protection against medical expenses |

When it comes to choosing the right coverage for your assets, it’s important to consider several key factors to ensure that you have adequate protection in place. Here are some tips for selecting the right insurance coverage for your assets: 1. Assess Your Risks: Start by identifying the potential risks and liabilities that could impact your assets.

This could include natural disasters, theft, lawsuits, or other unforeseen events. By understanding your specific risks, you can tailor your coverage to address those threats effectively. 2.

Evaluate Your Assets: Take stock of all your assets, including their value, location, and any unique characteristics that may require specialized coverage. This will help you determine the level of coverage needed for each asset and ensure that nothing is overlooked. 3.

Consult with an Expert: Seek guidance from an experienced insurance advisor or asset protection specialist who can help you navigate the complexities of asset protection and identify the most suitable coverage options for your needs. 4. Review Policy Terms: Carefully review the terms and conditions of any insurance policy before making a decision.

Pay attention to coverage limits, deductibles, exclusions, and any additional features or endorsements that may be available. 5. Consider Bundling Policies: In some cases, bundling multiple insurance policies with the same provider can result in cost savings and streamlined coverage options.

Explore the possibility of bundling your asset protection policies with other insurance products for added convenience and value.

Tips for Maximizing Your Asset Protection with Harita Insurance

In addition to choosing the right coverage for your assets, there are several strategies you can employ to maximize the effectiveness of your asset protection with Harita Insurance: 1. Regularly Review Your Coverage: As your financial situation evolves and your asset portfolio grows, it’s important to regularly review your insurance coverage to ensure that it remains aligned with your needs. This may involve adjusting coverage limits, adding new assets to your policy, or exploring additional coverage options as needed.

2. Implement Risk Management Strategies: In conjunction with insurance coverage, consider implementing risk management strategies to minimize the likelihood of potential threats impacting your assets. This could include security measures for your property, legal structuring for business assets, or diversification of investment holdings.

3. Maintain Accurate Records: Keep detailed records of all your assets, including appraisals, purchase receipts, and any relevant documentation that can support insurance claims in the event of a loss. 4.

Stay Informed: Stay informed about changes in insurance regulations, market trends, and emerging risks that could impact your assets. By staying proactive and informed, you can make more informed decisions about your asset protection strategy. 5.

Seek Professional Advice: When in doubt, seek professional advice from legal advisors, financial planners, or insurance experts who can provide valuable insights into optimizing your asset protection strategy.

Common Misconceptions about Asset Protection and Insurance

Underestimating Risk

Many individuals underestimate the potential risks that could impact their assets and assume that they don’t need asset protection until it’s too late. In reality, everyone can benefit from having a comprehensive asset protection strategy in place to mitigate potential threats.

Limits of Insurance Coverage

While insurance provides valuable protection for a wide range of risks, it’s important to recognize that not all risks may be covered under a standard policy. Understanding the limitations of insurance coverage can help you identify areas where additional protection may be necessary.

Myths About Who Needs Asset Protection

Asset protection is not just for high-net-worth individuals; it’s a fundamental aspect of financial planning that applies to anyone who has valuable assets to protect. Regardless of your wealth level, asset protection is essential for safeguarding your financial future. Additionally, one-size-fits-all coverage is a misconception – insurance needs vary widely based on individual circumstances and asset portfolios, making customized coverage essential for effective asset protection.

Simplifying the Process

While asset protection strategies can be complex, working with experienced professionals can simplify the process and ensure that you have the right level of protection in place without unnecessary complexity.

The Role of Harita Insurance in Safeguarding Your Financial Future

In conclusion, Harita Insurance plays a critical role in safeguarding the financial future of individuals and businesses by providing comprehensive asset protection solutions tailored to meet specific needs. By understanding the importance of asset protection, choosing the right coverage for your assets, and maximizing the effectiveness of your asset protection strategy with Harita Insurance, you can mitigate potential risks and liabilities while preserving the value of your wealth. With a diverse range of assets covered by Harita Insurance, including real estate, personal property, business assets, investment portfolios, and high-value assets, clients can benefit from customized coverage options designed to address their unique risks and liabilities.

By carefully evaluating their risks, consulting with experts, reviewing policy terms, and implementing risk management strategies, clients can maximize their asset protection with Harita Insurance while dispelling common misconceptions about asset protection and insurance. Ultimately, by partnering with Harita Insurance for asset protection needs, individuals and businesses can gain peace of mind knowing that their valuable assets are secure and protected against potential threats that could jeopardize their financial well-being. With a commitment to affordability, flexibility, and personalized service, Harita Insurance stands as a trusted partner in safeguarding the financial future of its clients through comprehensive asset protection solutions tailored to meet their specific needs.

If you’re interested in learning more about the intersection of insurance and technology, check out this article on VidaCrypto. This article explores how blockchain technology is revolutionizing the insurance industry, and how companies like Harita Insurance are leveraging this technology to improve their services and offerings. It’s a fascinating look at the future of insurance and the role that technology is playing in shaping it.

FAQs

What is Harita Insurance?

Harita Insurance is a type of insurance policy that provides coverage for various risks related to the transportation of goods, including damage, loss, or theft during transit.

What does Harita Insurance cover?

Harita Insurance typically covers risks such as damage, loss, or theft of goods during transit by road, rail, air, or sea. It may also provide coverage for other related risks such as fire, accidents, and natural disasters.

Who can benefit from Harita Insurance?

Businesses involved in the transportation of goods, including manufacturers, distributors, and logistics companies, can benefit from Harita Insurance to protect their goods while in transit.

How does Harita Insurance work?

Harita Insurance works by providing financial protection to the insured party in the event of damage, loss, or theft of goods during transit. The insured party pays a premium to the insurance company in exchange for this coverage.

How can I purchase Harita Insurance?

Harita Insurance can be purchased through insurance brokers or directly from insurance companies that offer this type of coverage. It is important to compare different policies and choose one that best suits your specific transportation needs.

Is Harita Insurance mandatory for transportation businesses?

Harita Insurance is not mandatory in all cases, but it is highly recommended for businesses involved in the transportation of goods to protect against potential financial losses due to transit-related risks. Some countries or regions may have specific regulations regarding the need for this type of insurance.