Financial inclusion is a key factor in economic development and poverty reduction. It encompasses the availability and use of financial services for individuals and businesses across all income levels. Access to financial products such as savings accounts, credit facilities, insurance, and payment services enables people to better manage their finances, invest in education and healthcare, and expand their businesses.

Financial inclusion is also crucial for promoting gender equality, as women are often underrepresented in formal financial systems. By providing access to financial services, communities can become more resilient to economic challenges and improve their overall quality of life. Arc Finance acknowledges the significance of financial inclusion in empowering communities and considers access to financial solutions a basic human right.

Without such access, individuals and communities often resort to informal and potentially exploitative financial practices, which can perpetuate poverty cycles. By promoting financial inclusion, Arc Finance aims to foster economic growth opportunities and enhance the quality of life for underserved populations globally. Through its innovative approaches, Arc Finance has made a substantial impact on millions of lives by providing essential tools for building a better future.

Key Takeaways

- Financial inclusion is crucial for empowering communities and reducing poverty

- Arc Finance focuses on providing access to financial solutions to underserved communities

- Access to financial solutions can lead to improved livelihoods and economic stability for communities

- Case studies demonstrate the positive impact of financial inclusion on empowered communities

- Overcoming barriers to financial inclusion is essential for sustainable development and poverty reduction

Arc Finance’s Approach to Empowering Communities

Understanding Community Needs

By understanding the specific challenges and opportunities facing each community, Arc Finance is able to design and implement effective financial solutions that have a lasting impact.

Building Capacity and Innovation

One of the key components of Arc Finance’s approach is its focus on building the capacity of local financial institutions and service providers. By working with these organizations to develop innovative products and delivery channels, Arc Finance is able to expand access to financial services in a way that is both sustainable and scalable.

Leveraging Technology for Inclusion

Additionally, Arc Finance places a strong emphasis on leveraging technology to increase the reach and efficiency of financial services. Through the use of mobile banking, digital payments, and other technological innovations, Arc Finance is able to overcome traditional barriers to financial inclusion and reach even the most remote communities. Overall, Arc Finance’s approach is centered around empowering communities to take control of their financial futures and build a more prosperous tomorrow.

The Impact of Access to Financial Solutions on Communities

Access to financial solutions has a profound impact on communities, leading to improved economic stability, increased resilience, and enhanced overall well-being. When individuals and businesses have access to savings accounts, credit, insurance, and payment services, they are better able to manage their finances, invest in education and healthcare, and grow their businesses. This leads to increased economic activity and job creation within the community, ultimately contributing to poverty reduction and economic development.

Additionally, access to financial services can help communities build resilience against economic shocks and natural disasters by providing them with the means to save for emergencies and access insurance products. Furthermore, access to financial solutions can have a transformative effect on gender equality within communities. Women are often disproportionately excluded from formal financial systems, which can limit their economic opportunities and independence.

By providing women with access to savings accounts, credit, and other financial services, communities can empower them to take control of their finances and improve their overall well-being. This can lead to increased investments in education and healthcare for women and their families, ultimately contributing to the long-term development of the community as a whole. Overall, access to financial solutions has a far-reaching impact on communities, leading to increased economic stability, improved resilience, and enhanced gender equality.

Case Studies: Success Stories of Empowered Communities

| Community | Success Story | Metric |

|---|---|---|

| Village A | Improved access to clean water | 50% reduction in waterborne diseases |

| Neighborhood B | Renewable energy adoption | 80% decrease in carbon emissions |

| Town C | Education empowerment | 30% increase in high school graduation rates |

Arc Finance has been instrumental in empowering communities around the world through its innovative approach to financial inclusion. One such success story comes from rural India, where Arc Finance worked with local microfinance institutions to provide access to affordable credit for smallholder farmers. By leveraging mobile banking technology, Arc Finance was able to reach farmers in remote areas who had previously been excluded from formal financial systems.

As a result, these farmers were able to invest in improved agricultural practices and equipment, leading to increased productivity and higher incomes for their families. This not only improved the economic stability of the farmers but also had a ripple effect on the entire community by creating new economic opportunities. Another success story comes from East Africa, where Arc Finance partnered with local financial institutions to provide access to solar energy financing for off-grid communities.

By offering affordable loans for solar home systems, Arc Finance was able to improve energy access for thousands of households, leading to significant improvements in health, education, and economic productivity. Families were able to save money on kerosene and other traditional fuels while also increasing their productivity by having access to reliable electricity. This not only improved the quality of life for these families but also contributed to environmental sustainability by reducing reliance on fossil fuels.

These success stories demonstrate the transformative impact that access to financial solutions can have on communities around the world.

Overcoming Barriers to Financial Inclusion

Despite the numerous benefits of financial inclusion, there are several barriers that prevent many communities from accessing formal financial services. One such barrier is the lack of physical infrastructure in remote areas, which makes it difficult for traditional banks to reach underserved populations. Additionally, many individuals lack the necessary documentation or collateral required by formal financial institutions to open accounts or access credit.

Furthermore, cultural and social barriers can also prevent certain groups, such as women or minority populations, from accessing financial services due to discriminatory practices or lack of awareness. Arc Finance has been successful in overcoming these barriers by leveraging technology and innovative delivery channels to reach underserved communities. By partnering with local microfinance institutions and mobile network operators, Arc Finance has been able to expand access to financial services in even the most remote areas.

Additionally, Arc Finance works with communities to raise awareness about the benefits of financial inclusion and provide education on how to use formal financial services effectively. By addressing these barriers head-on, Arc Finance has been able to make significant strides in improving access to financial solutions for underserved communities around the world.

Collaborating with Communities: Arc Finance’s Partnership Model

Collaborative Approach to Financial Solutions

Our partnership model centers around working closely with local stakeholders to develop sustainable and scalable financial solutions that meet the unique needs of each community. By partnering with local microfinance institutions, technology providers, and community organizations, we leverage local knowledge and expertise to design effective programs that have a lasting impact.

Building Capacity for Sustainable Delivery

Our partnership model also emphasizes building the capacity of local stakeholders to deliver financial services effectively. We provide training and technical assistance to local microfinance institutions and service providers, ensuring they have the necessary skills and resources to reach underserved populations in a sustainable manner.

Sustainable Impact through Empowerment

By empowering local stakeholders, we strengthen the local financial ecosystem and create new economic opportunities for individuals within the community. This collaborative approach ensures that the solutions developed are tailored to the specific challenges and opportunities facing each community, leading to greater acceptance and adoption by community members.

The Future of Financial Inclusion: Arc Finance’s Vision

Looking ahead, Arc Finance envisions a future where every individual and community has access to affordable and sustainable financial solutions that enable them to build a better future. The organization is committed to continuing its work in empowering underserved communities through innovative approaches to financial inclusion. This includes expanding access to digital financial services, promoting gender equality within formal financial systems, and leveraging technology to overcome traditional barriers to financial inclusion.

Arc Finance also aims to continue building partnerships with local stakeholders and fostering collaboration within communities to develop effective financial solutions that meet their unique needs. By working together with local microfinance institutions, technology providers, and community organizations, Arc Finance believes that it can create lasting impact for millions of people around the world. Ultimately, Arc Finance’s vision for the future is one where every individual has the opportunity to achieve economic stability and improve their overall well-being through access to financial solutions.

In conclusion, financial inclusion plays a crucial role in empowering communities and promoting economic development around the world. Through its innovative approach, Arc Finance has been able to make a significant impact on the lives of millions of people by providing them with access to affordable and sustainable financial solutions. By overcoming traditional barriers and collaborating with local stakeholders, Arc Finance has been able to create lasting impact for underserved communities around the world.

As the organization looks ahead, it remains committed to its vision of creating a future where every individual has access to the tools they need to build a better tomorrow through financial inclusion.

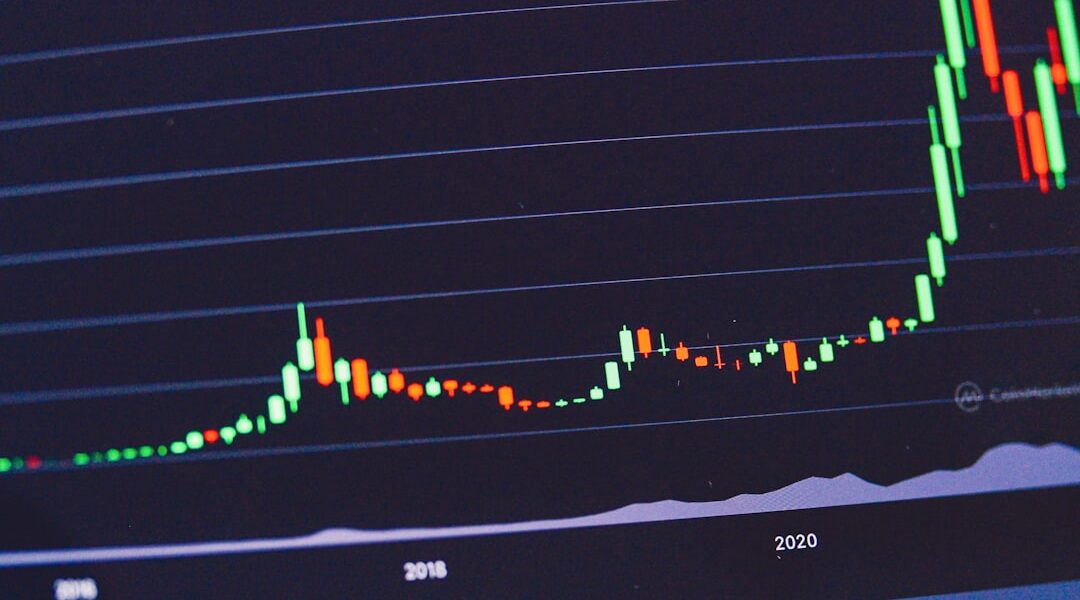

If you’re interested in learning more about the intersection of finance and cryptocurrency, check out this article on VidaCrypto. It explores the potential impact of digital currencies on traditional financial systems and how they are being integrated into the world of finance. This article provides valuable insights into the evolving landscape of finance and the role that cryptocurrency is playing in shaping its future.

FAQs

What is arc finance?

Arc finance refers to the financial services and products that are specifically designed to meet the needs of individuals and businesses in the agriculture, rural, and cottage industries.

What are the key features of arc finance?

Arc finance typically includes services such as microfinance, agricultural insurance, savings and credit cooperatives, and other financial tools tailored to the unique needs of rural and agricultural communities.

Why is arc finance important?

Arc finance plays a crucial role in providing financial inclusion and access to essential financial services for individuals and businesses in rural and agricultural sectors, helping to improve livelihoods and promote economic development.

How does arc finance differ from traditional finance?

Arc finance differs from traditional finance in that it is specifically tailored to the needs and circumstances of rural and agricultural communities, often offering smaller loan sizes, flexible repayment schedules, and agricultural-specific financial products.

What are some examples of arc finance products?

Examples of arc finance products include agricultural microloans, weather index-based insurance, savings and credit cooperatives, and mobile banking services designed for rural and agricultural communities.

How does arc finance impact rural and agricultural communities?

Arc finance can have a significant impact on rural and agricultural communities by providing access to essential financial services, promoting entrepreneurship, and supporting sustainable agricultural practices and rural development.