Dhani Finance is a financial services company offering a variety of products and services to meet customer needs. Their quick loans are designed for individuals requiring immediate financial assistance. These loans feature a streamlined application process, competitive interest rates, and flexible repayment terms.

The company aims to provide transparent and customer-focused financial solutions to help individuals achieve their financial objectives. Dhani Finance has leveraged technology to simplify the lending process, making it more accessible and convenient for customers to obtain funds when needed. Their quick loans are intended to address various financial needs, such as unexpected medical expenses or home repairs.

Dhani Finance’s commitment to innovation and customer service has contributed to the popularity of their quick loan offerings among individuals seeking reliable financial support during temporary financial difficulties.

Key Takeaways

- Dhani Finance offers quick loans with a simple and hassle-free application process.

- Quick loans provide immediate financial assistance and can be used for various purposes.

- Dhani Finance works by providing instant loans through a digital platform, eliminating the need for lengthy paperwork and waiting periods.

- Eligibility criteria for Dhani Finance quick loans include a minimum age requirement and a steady source of income.

- The application process for Dhani Finance quick loans is straightforward and can be completed online within minutes.

- Repayment options for Dhani Finance quick loans are flexible, with varying terms to suit different financial situations.

- Customer reviews and testimonials highlight the ease of use and efficiency of Dhani Finance quick loans.

Understanding Quick Loans and Their Benefits

Speed and Convenience

These loans are typically unsecured, meaning they do not require any collateral, and are often approved and disbursed within a short period of time, making them an ideal solution for individuals in need of fast cash. One of the key benefits of quick loans is their speed and convenience, as they can be accessed online or through mobile apps, eliminating the need for lengthy paperwork and time-consuming approval processes.

Flexible Repayment Options

In addition to their speed and convenience, quick loans also offer flexibility in terms of repayment options, allowing borrowers to choose a repayment schedule that best suits their financial situation. This can be particularly helpful for individuals facing temporary financial challenges or unexpected expenses, as it provides them with the flexibility to repay the loan in a way that is manageable for them.

Building or Improving Credit Score

Furthermore, quick loans can also help individuals build or improve their credit score, as timely repayment of the loan can demonstrate responsible financial behavior to credit bureaus.

How Dhani Finance Works

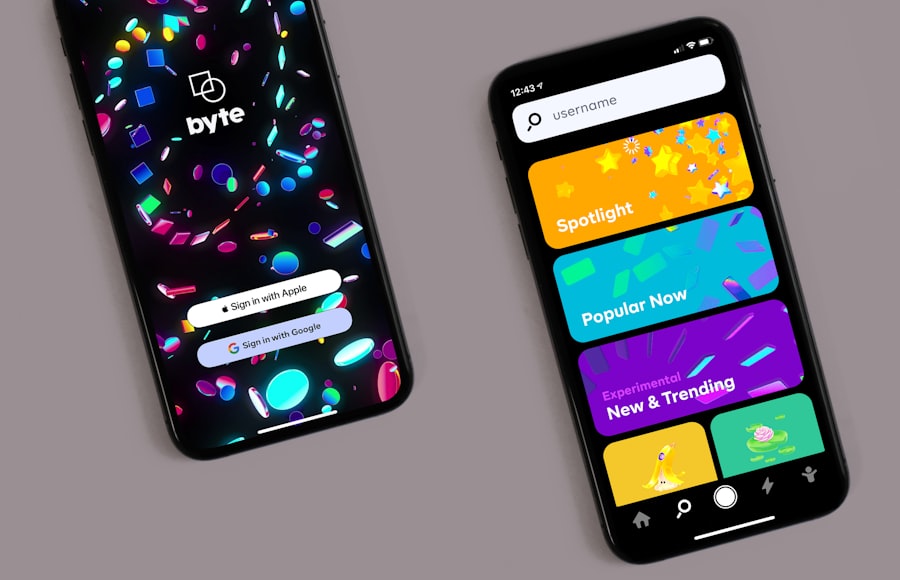

Dhani Finance offers quick loans through its user-friendly mobile app, which allows customers to apply for a loan, track their application status, and manage their loan account all in one place. The app is designed to provide a seamless and convenient experience for customers, with features such as instant loan approval, quick disbursal of funds, and easy repayment options. Customers can also access personalized loan offers based on their credit profile and financial needs, making it easier for them to find the right loan product for their specific requirements.

Dhani Finance leverages advanced technology and data analytics to assess the creditworthiness of applicants and make quick lending decisions. This allows the company to offer competitive interest rates and favorable terms to eligible borrowers, ensuring that they have access to affordable and transparent financial solutions. With a strong focus on customer satisfaction and convenience, Dhani Finance is committed to providing a seamless and hassle-free borrowing experience for its customers, making it easier for them to access the funds they need when they need them.

Eligibility Criteria for Dhani Finance Quick Loans

| Eligibility Criteria | Requirements |

|---|---|

| Age | Minimum 21 years and maximum 65 years |

| Income | Minimum monthly income of Rs. 20,000 |

| Employment | Salaried or self-employed with regular source of income |

| Credit Score | Good credit history preferred |

| Documentation | Valid ID proof, address proof, and income documents |

To be eligible for a quick loan from Dhani Finance, applicants must meet certain criteria set by the company. These criteria may include age, income, employment status, credit history, and other factors that are used to assess the creditworthiness of the applicant. Typically, applicants must be at least 21 years old and have a stable source of income to qualify for a quick loan from Dhani Finance.

Additionally, applicants may be required to provide certain documents such as proof of identity, address, and income to support their loan application. Dhani Finance may also consider the credit score of the applicant when evaluating their eligibility for a quick loan. While a good credit score is not always a strict requirement for quick loans from Dhani Finance, it can have an impact on the interest rate and loan terms offered to the borrower.

Individuals with a higher credit score may be eligible for lower interest rates and more favorable loan terms, while those with a lower credit score may still qualify for a loan but at slightly higher interest rates.

Application Process for Dhani Finance Quick Loans

The application process for Dhani Finance quick loans is designed to be simple, convenient, and user-friendly. Customers can apply for a loan through the Dhani app by providing basic personal and financial information, such as their name, address, income details, and employment information. The app also allows customers to upload supporting documents directly from their mobile device, eliminating the need for physical paperwork or in-person visits to a branch location.

Once the application is submitted, Dhani Finance uses advanced algorithms and data analytics to assess the creditworthiness of the applicant and make an instant lending decision. If the loan is approved, the funds are disbursed directly into the customer’s bank account within a short period of time, often within minutes. This quick disbursal process ensures that customers have immediate access to the funds they need without any unnecessary delays or complications.

Repayment Options and Terms

Customizable Repayment Schedules

Customers can choose from various repayment schedules, including monthly installments or lump-sum payments, depending on their financial situation and preferences. This flexibility allows them to manage their finances effectively and repay their loan according to their needs.

No Prepayment Penalties

Additionally, Dhani Finance offers customers the option to prepay their loan at any time without incurring any prepayment penalties. This allows them to save on interest costs and repay the loan ahead of schedule if they wish to do so.

Transparent Loan Terms

The terms of Dhani Finance quick loans are designed to be transparent and easy to understand, with no hidden fees or charges. Customers are provided with a clear overview of the loan terms, including the interest rate, repayment schedule, total loan amount, and any applicable fees before they accept the loan offer. This transparency ensures that customers are fully informed about the terms of their loan and can make an informed decision about whether it is the right financial solution for them.

Customer Reviews and Testimonials

Customer reviews and testimonials play an important role in shaping the reputation of any financial services company, including Dhani Finance. Many customers have shared positive experiences with Dhani Finance quick loans, highlighting the speed and convenience of the application process, competitive interest rates, and excellent customer service. Customers have also praised Dhani Finance for its transparent and customer-centric approach to lending, as well as its commitment to providing flexible repayment options that cater to the diverse needs of its customers.

In addition to positive reviews, Dhani Finance has also received numerous testimonials from satisfied customers who have successfully used quick loans from the company to address their urgent financial needs. These testimonials often highlight how Dhani Finance quick loans have provided individuals with much-needed financial assistance during challenging times, allowing them to overcome temporary financial setbacks and regain control over their finances. Overall, customer reviews and testimonials serve as a testament to the reliability and trustworthiness of Dhani Finance as a leading provider of quick loans in the market.

In conclusion, Dhani Finance quick loans offer a convenient and reliable solution for individuals in need of immediate financial assistance. With a seamless application process, competitive interest rates, flexible repayment options, and transparent terms, Dhani Finance has established itself as a trusted partner for individuals facing temporary financial challenges. By leveraging advanced technology and data analytics, Dhani Finance has streamlined the lending process, making it easier for customers to access the funds they need when they need them.

Customer reviews and testimonials further attest to the positive impact of Dhani Finance quick loans on individuals’ lives, highlighting the company’s commitment to providing transparent and customer-centric financial solutions.

If you’re interested in learning more about the world of cryptocurrency and how it relates to finance, check out this article on VidaCrypto. It provides valuable insights into the intersection of digital currency and traditional lending, which is particularly relevant to the innovative approach of Dhani Finance Loan. Understanding the potential impact of cryptocurrency on the lending industry can provide a broader perspective on the future of finance.

FAQs

What is a dhani finance loan?

A dhani finance loan is a type of personal loan offered by dhani services, a digital lending platform in India. These loans are designed to provide quick and convenient access to funds for various personal and financial needs.

How can I apply for a dhani finance loan?

You can apply for a dhani finance loan through the dhani app or website. The application process is simple and can be completed online. You will need to provide personal and financial information, and once approved, the funds will be disbursed directly to your bank account.

What are the eligibility criteria for a dhani finance loan?

The eligibility criteria for a dhani finance loan may include factors such as age, income, employment status, credit history, and residency. Specific requirements may vary, so it’s important to check the eligibility criteria before applying.

What are the interest rates and fees for a dhani finance loan?

The interest rates and fees for a dhani finance loan may vary based on factors such as the loan amount, repayment tenure, and the applicant’s credit profile. It’s important to review the terms and conditions to understand the applicable interest rates and fees before accepting the loan offer.

What can I use a dhani finance loan for?

A dhani finance loan can be used for various personal and financial needs, such as medical expenses, home renovations, travel, education, debt consolidation, and more. The funds can be used at the borrower’s discretion, as long as it aligns with the loan terms and conditions.

How long does it take to receive the funds from a dhani finance loan?

Once approved, the funds from a dhani finance loan are typically disbursed directly to the borrower’s bank account within a short period, often within a few hours or days. The exact timeline may vary based on the applicant’s bank and other factors.